Pierre, South Dakota – In what is being heralded as an “opportunity for a phoenix to rise out of the ashes,” a new piece of legislation proposing property tax credits for education has sparked intense debate across South Dakota. State Senator John Carley, Republican from Piedmont, has pushed the bill through the state’s legislative committee, with the potential to change the landscape of education funding in South Dakota.

The legislation aims to provide property tax credits to assist families in paying for private schooling, homeschooling, or alternative instructional methods. This proposed shift in funding priorities highlights an ongoing conversation about school choice in the state, represented by different community interests and political viewpoints.

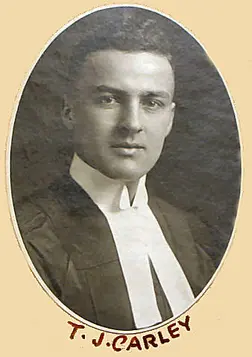

John Carley

Tongi Weaver, a Rapid City resident representing the conservative political action group Citizens for Liberty, referred to the bill as an opportunity for revival. She drew parallels with past failures to establish publicly funded savings accounts for families’ nonpublic education costs, emphasizing the renewed hope this bill represents for proponents of school choice.

Under Carley’s bill, property owners across South Dakota could utilize tax credits not only for their children but also to support the education of other children. The proposed credit is capped at 80% of the allocation per public school student, initially projected to be approximately $6,000 per taxpayer. This mechanism is seen as a pivotal factor in facilitating more educational options for parents looking beyond the public school system.

However, the proposed legislation is not without its critics. Dianna Miller, a lobbyist advocating for South Dakota’s large school districts, voiced concerns over the financial implications of the bill. The legislation could potentially translate to a $14 million to $21 million annual revenue loss for school districts, compelling the state to shoulder an increased burden of education funding. This concern underscores the broader issue of balancing education financing between local and state responsibilities.

The state’s Department of Revenue, alongside several public school representatives, has voiced opposition to the bill. They predict an increase in administrative duties and warn of accountability loopholes that might emerge if the bill passes into law. One such concern is ensuring that children benefitting from these tax credits are genuinely receiving a standardized form of education, an issue critics fear remains unaddressed by the current draft of the legislation.

Dianna Miller

Sam Nelson, representing the Sioux Falls School District, articulated the apprehensions shared by public school officials by questioning the precedent that such a funding model might set. “If we allow people to opt-out of supporting fundamental community services such as public schools, it opens the door for selective funding of other public infrastructure,” Nelson remarked.

Despite these concerns, the bill narrowly advanced out of the Senate Education Committee following a 4-3 vote. It now awaits deliberation in the full Senate, where the stakes will extend beyond policy specifics, touching the very underpinnings of community values and state educational philosophies.

The advancement of this bill marks a significant moment for South Dakota, where the delicate balance between educational choice, fiscal responsibility, and public accountability continues to shape legislative efforts. As South Dakota navigates these intricate challenges, the decision stands to affect not only the state’s 90,000+ K-12 students but also the broader fabric of society that relies on robust educational systems.

For further updates on this developing story and other news, subscribe to our newsletter or contact us at [email protected].